Payment Services Directive

LIBRA INTERNET BANK increases the safety of your bank transactions

LIBRA INTERNET BANK BANK implements the Payment Services Directive - known as PSD2 (Payments Services Directive No 2366/2015 on payment services in the internal market, supplemented by the European Regulation No.389/2018 supplementing Directive (EU) 2015/2366 on regulatory technical standards for strict client authentication and open, common and secure communication standards), transposed into Romanian legislation by law No. 209/2019 on payment services and for modification of some normative acts, published in Monitorul Oficial Nr.913 from 13.11.2019.

Thus, as of December 13, 2019, as a result of the new regulations, Libra Internet Bank brings a series of changes regarding online payments, in order to increase the security of the transactions and the compliance with the new provisions.

The directive imposes the protection of the users, by using at least 2 of the 3 authentication methods to verify the identity of the users:

- knowledge-based methods (passwords, PINs)

- Possession-based methods (smartphone-type device)

- methods based on identity (biometrics).

As a result, electronic payments will require authentication through 2 security factors .

New rules for Libra Internet Banking and Libra Mobile Banking

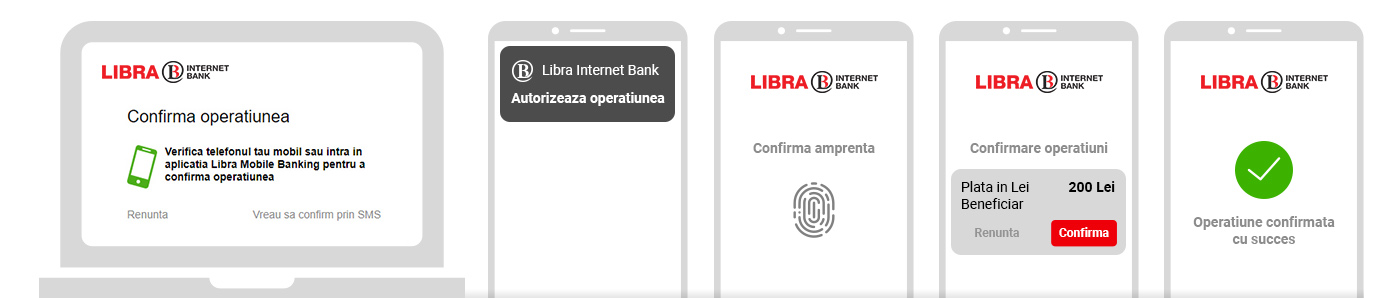

Authentication and transactions in Libra Internet Banking and Libra Mobile Banking can only be done with strict Client Authentication (SCA authentication), PIN or Biometrics (fingerprint or face recognition), through the Libra Mobile Banking application.

Alternatively, customers who do not have the Libra Mobile Banking application installed or who do not want to authenticate and perform transactions by PIN or Biometrics (as a 2nd security factor), can use the unique dynamic 3D-Secure SMS password (OTP SMS ).

New services - you can make your payment accounts accessible online to third party Payment Service Providers (PSP)

The new services give you the possibility to grant, based on your express consent, access to your accounts to another bank or to a fintech (third party PSP), payment service provider. Based on your request and consent, the bank will allow the third-party PSP access to the data in your accounts. Thus, you will be able to benefit from new services offered by third party PSPs as well:

- payment initiation service - you will be able to pay directly from your current account, through the payment service provider's application

- the account information service - you will be able to view the balance and the transactions in your payment account, through the computer application of the payment service provider

- confirmation of availability of funds - the payment service provider will be able to verify the availability of a certain amount, in your account .

The consent is valid as long as it has not been revoked. The revocation of the consent can be made from the computer application of the third party PSP, payment service provider.